I first started my investment journey when I was 23, in mid 2014 (by reading investment books), bought my first company (Disney) in March 2015, and in the blink of an eye, it’s late 2017 now, which means that I have been investing in the market for close to 2.5 years. It has been an interesting journey and I really enjoy investing and examining companies.

I have always wanted to start an investment blog, as I think it will force me to think harder about my investments and crystallise my thoughts, which would help me to develop into a better investor and achieve better returns too. However, I have never gotten myself to doing it.

In January 2016, I wrote a post on Medium titled “4 Thoughts on Personal Finance and Investing that You Have to Know in Your 20s“.

And after a long one year , in January 2017, I advanced slightly further, starting my Facebook page – The Nomad Investor, where I mainly share my thoughts, investment lessons that I have learnt and investment articles that I find useful.

That’s all I got around doing. So what made me finally work on starting a real proper blog?

The answer lies partly in Howard Mark’s most recent memo “There They Go Again … Again“, and partly in Safal Niveshak’s (an Indian value investor whom I follow) article on Howard’s memo.

In that memo, Howard expressed his view on the prevailing market sentiment, on high asset prices, low risk aversion, low prospective returns, too much capital chasing after too little returns, etc, etc. After reading his 23-page long memo, I strongly agree with him and personally am very wary of the current rich valuations in the market, but will, as he suggests, continue to move forward, but with more caution.

Then, I chanced upon Safal Niveshak’s article on Howard’s memo. At the end of his article, he touched on seven things that he is currently doing now on his savings and investments. And the seventh strikes out to me.

Seventh (and I’ll end here for it’s my lucky number), I am spending less and less time thinking and looking at the stock market and my stocks, and more time reading, doing nothing, and fooling around with my family. That keeps me away from all or any madness that others deeply involved in stocks may be bearing now.

– Safal Niveshak

At that point, I thought that since I find it difficult to uncover good undervalued investments now, maybe I should spend more of my time reading books or finally kicking myself to write that blog that I have always wanted to write!

And here it comes – my first investment blog – The Nomad Investor, to keep me away from all or any madness that many are involved in now.

I have written more about myself here and my investment philosophy here.

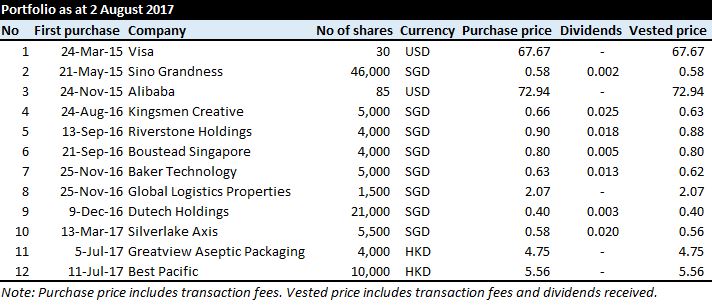

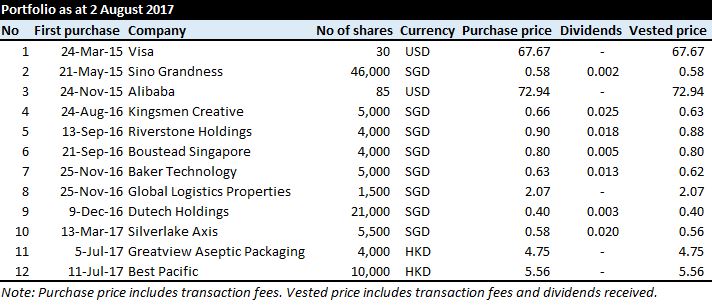

I thought it would be good to end off with my current portfolio, which will give you a better idea of what companies do I generally look at. My goal now is to be more serious about my investing from now on and I plan to review my investments and restructure my portfolio slightly in the coming months, and blog about them where relevant.

So here’s a quick peek into my current portfolio, which consists of companies that I intend to keep for long and companies that I plan to divest soon. Feel free to let me know of any thoughts or questions that you have.