Capilano Honey, a company which I partially owned since January this year, received a take-private offer early this week. This becomes the second take-private offer I received in my investment journey, after GLP in 2017.

The price? Cash offer of AUD 20.06 per share , translating to equity value of around AUD 190m, with the option to receive scrip shares in the new entity. This offer price represents a 28% premium over the last close price (AUD 15.65) and implies a FY18 P/E of 19.3x (on earnings which I consider to be still depressed) and FY18 EV/EBITDA of 12.5x.

The buyer? A private equity group (Wattle Hill), co-founded by Albert Tse (the husband of Jessica Rudd, daughter of former Australian prime minister Kevin Rudd… LOL), specialising in China-focused agricultural exports.

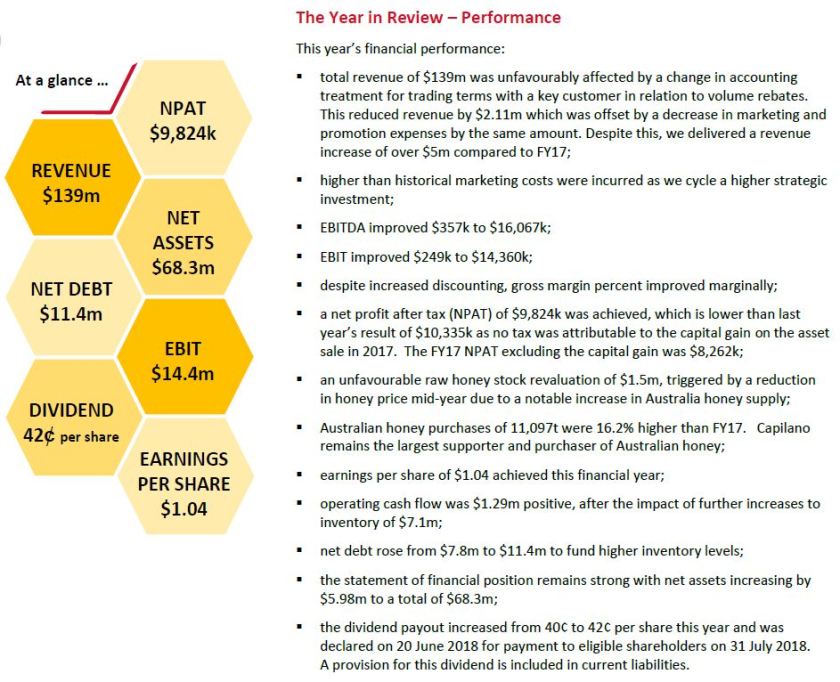

At the same time, Capilano also released its FY2018 results, which were quite good in my opinion.

- Revenue increased by 4% to AUD 139m;

- Operating profit increased by 19.6% to AUD 14.0m (disregarding the one-off non-operating capital gain of AUD 2.1m last year); and

- Honey stock further improving to 6,746 tonnes from 5,953 tonnes last year with better season (although Eastern Australia started seeing increasingly apparent dry conditions in recent months).

Kerry Stokes, who has 21% voting power via Wroxby Pty Ltd, has already indicated to vote for scrip consideration and the deal is likely to go through.

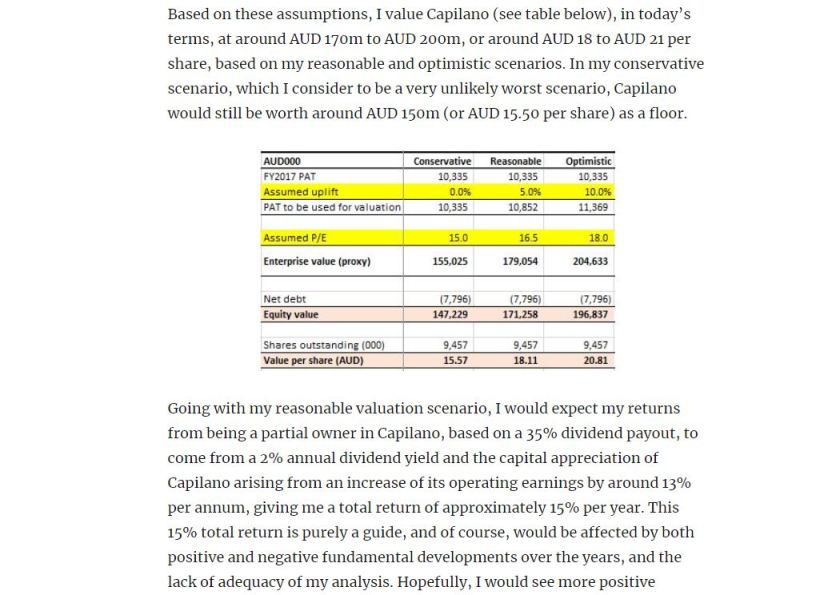

The offer valuation of AUD 190m lies towards the upper range of my valuation of AUD 170m to AUD 200m made in January 2018. And I feel that the offer price could have been a bit higher, at around AUD 200m or even slightly more (given the benefits that the buyer would accrue, from recovery in earnings and likely expansion into China utilisting their expertise and networks).

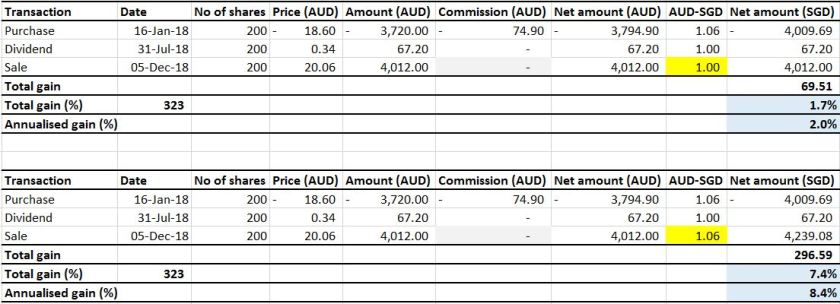

I purchased it at AUD 18.60 per share, or AUD 176m for the whole equity. And I received a dividend of AUD 0.34 per share in July, so this should imply a return of approximately 10% [= (AUD 20.06 + AUD 0.34) / AUD 18.60 – 1].

But my returns? It depends largely on how AUD performs against SGD in the coming months.

For now, assuming I hold it till take-private happening in 5 December this year and AUD-SGD remains at the current rate of 1.0x till then, my returns would be a mere 1.7% (after taking into transaction fee, of a whopping AUD 75 (or 2% of my purchase cost) from OCBC Securities, which I discovered it to be this high only after I received the transaction statement – I thought it would like in the range of AUD 25 similar to other markets, but lesson learned).

If lady luck is with me, and AUD appreciates back to 1.06 SGD (the rate I purchased in January) by December, then my return would improve to 7.4% (for 10 months), or annualised rate of 8.4%, which is sub-par and below my expectations. Nevertheless, still a good and interesting ride and a first attempt in buying an Australian company.

Given that I am based in a foreign country outside of Australia, with my shares purchased through custodian by my brokerage firm, opting for scrip in the new entity would be risky and unwise for me in my opinion.

So for now, all I have to do is wait for the privatisation to happen end of this year and hope for an appreciation in AUD (I’m unlikely to sell before that, to avoid incurring the whopping high transaction fee charged by OCBC Securities again) (or hope for someone else to come in with a higher bid, which would be a blue moon LOL).

To end my journey with Capilano (I have been following Capilano hashtag on Instagram, joining Australian beekeepers forum on Facebook, checking out Capilano’s products whenever I am in a supermarket, etc), let’s hear back and enjoy this catchy Capilano song! (scroll to 14:53)

Interesting that you both follow me and follow this 🙂 I had this on my observation list for quite a while now. Since Capilano is gone the question is what we think about Comvita, have you looked at that too? More premium segment, but I think premium is better than regular honey. The valuation has been high though, but come down nicely lately. If we look adjusted for a more normal harvest season the valuation is pretty attractive.. ..almost pulling the trigger, curious to hear your thinking!

Cheers

GlobalStockPicking

LikeLike

Hi Globalstockpicking. Thank you for your comments. Yes I saw you have Capilano and Comvita in your watchlist when I went through your blog. I am also very long BYD (comparable to your LG Chem), and have some serious concerns on Fu Shou Yuan despite its great business. On Fu Shou Yuan, I have posted my concerns at the blog whom you referred to in your analysis, to which the author seems to have no answers until now. It would be good to hear your thoughts on that.

Coming back to honey, I have only briefly looked at Comvita for certain reasons which I explain later. I think its branding is definitely much stronger than Capilano, and its position in China which is growing is already well entrenched, so all is good. However, I wanted a pure honey play last time so I didnt look much into Comvita. Furthermore, I felt that Comvita’s annual report is basically a marketing brochure without much information that I want to know in the report, so I was put off by that. Do you agree on this, and if not, where do/can you find much more fundamental information about the company’s business and operations?

Also, out of curiosity, where are you based? I am based in Singapore.

Cheers,

Nomad Investor

LikeLike