Over the last weekend (27-28 January), I attended the Value Investing Summit (VIS) 2018 at Expo. I bought the ticket at S$150 from someone who couldn’t make it after buying the ticket. Overall, it’s a good event (depending on the line-up of speakers) and well worth attending if you have the time.

There are quite many learning points for me, and quite some that reinforce (and shed slightly new perspectives on) what I already know (which is a good thing too). And it’s quite inspiriting to see so many Charlie Munger and Warren Buffet (‘s thinkings and wisdom) in the speakers in the room, in fact more so on the former, whom I have recently demonstrated a newfound appreciation for. And even more encouraging to know that most of them (especially Vishal and Hemant Amin, who compounded the capital that he manages at >30% annually for more than 14 years with a 10-stock concentrated portfolio) have very similar investing philosophies, strategies and processes as mine (which I found only after 2 years of investing and lots of readings), although of course, I am still way behind them.

I shall list down the more major learning points here, viewed in my own lens (and very drowsy eyes and practically nonfunctional brain on the first morning due to a late night (2am+) out prior).

Day 1 (27 January)

Kee Koon Boon – Hidden Champions and Value Investing

- I have been following his articles for some time and so I have already appreciated quite some of his thinking and wisdom

- But it’s good to finally see him in person, and understand more of his personality (he was more gentle than I thought, and very knowledgeable and well-read) and the things that drive him (including intellectual pursuit and value-adding to society)

- Also, think resilience

Hermann Simon – Hidden Champions – The Vanguard of Globeria: Success Strategies of Unknown World Market Leaders

- Hermann is the one who created the “Hidden Champion” concept. He is a German Professor (Doctor), author and business leader. He is also the chairman of Simon-Kucher & Partners, which specialises in strategy, marketing and pricing (he himself is a hidden champion to me, who has run his firm for more than 30 years)

- Hidden champion is all around us, creating products/services that we use all the time, often unnoticed and hidden behind, which is why they have the potential to appreciate in value and compound its value for a lot of times

- Listening to his talk prompts me to think whether the companies that I own or am looking at has the traits/characteristics of the hidden champions, which are good ones to have

- Germany’s Hidden Champions of the Mittelstand – which refers to world-class, export-oriented small and medium-sized enterprises (SMEs)

- He is here to talk about businesses (and not investing), but because investing requires understanding of businesses, therefore it helps. It also reinforces to me the idea that I should be focusing on understanding businesses (and the business model), not equities, thus the term business analyst instead of equity analyst as said by Warren Buffett

- Examples of Hidden Champions that struck with me include: Wanzl (trolley), Flexi (leash), Essilor (optic lens), Paiho Group (velcro fastener), Wirecard (payment processing)

- Laser focus in a niche (that’s how you produce superior value), but still replicate and scale globally (within that niche area), therefore providing avenue for growth. And mono-maniac (leader)

- On digitalisation – For B2C is already very advanced; For B2B there’s still much room to go, therefore providing opportunities to businesses and we investors. This is because B2B digitalisation is usually more complex and hard to integrate/implement. For us, as investors, look out for companies that are in the space of, or would benefit from, B2B digitalisation – they provide stable (sticky) cash flows and are associated with high switching costs. In my mind, I run through the companies in my portfolio, and I can only think of Silverlake as more of playing in this area. I shall hunt for more such companies

Joshua Zhang – Case Study

- Joshua is an analyst with the Hidden Champion Fund I believe. His presentation was good and solid, with very organised thought and thesis flow and good slides and presentation skills, and I still have a long way to catch up to that type of level

- He presented on Kadoya Sesame Mills (JP: 2612), which is a hidden champion

- Laser focus on sesame oil; strong moats – culture, know-how (160 years of experience and knowledge)

- Interesting company and maybe I would examine at some point if the materials in English are not inadequate

周贵银 (Zhou Gui Yin) – The Power of ROE (in Mandarin – interpreted)

- One of my two favourites (together with Vishal)

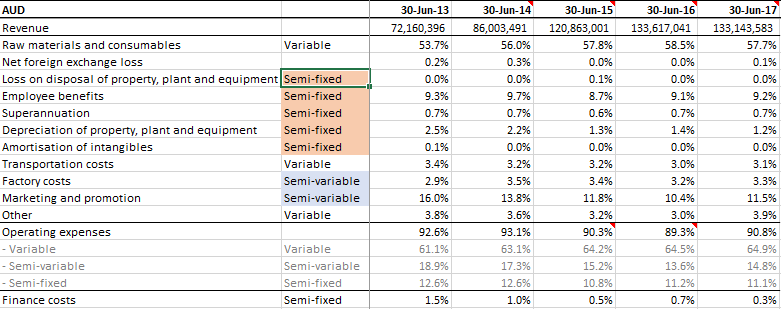

- 周老师 is from China and he is a super Charlie Munger (lateral and multidisciplinary thinking), and presented on his 觉悟智慧 (and/or 融道智慧), which discusses the integration of the Chinese philosophies and ancient thinking (佛家思想,,易经,道家,儒家,佛家,兵家,老子,孙子,etc etc) with investing

- Overall, I think these points are very good in shaping and building up one’s character, emotional control, temperament, life philosophies, which are at least as important as, if not more than, diligence, IQ, analytical work and number crunching, etc.

- These are very high level and more philosophical, and somehow I appreciate it a lot. But I think I am still not at a stage to start studying those Chinese philosophies and teachings to really master the points, and shall leave them to a later stage when I build up more of the other areas first

- Some of the points that I like/connect more are:

- 佛家思想 – 三大境界/领悟:看山是山,看山不是山,看山还是山 – Static dynamism (and in another perspective (in my own words), one can see it as the zoom-in-zoom-out approach/mental model which is very useful in investing)

- 内圣外王 – 行者 – 无,空 – 只拿不给的话,会导致欲望越来越大,导致我们不能客观 – Be very wary of this, which I think is very true –

- 道家 – 无,为 – 不要过意的去干悟它 – Time is the best friend of a good business

- 泰来否极 (always be on the look-out for any potential downfall or disaster – humility and constant cautiousness (like Howard Marks)),而不是否极泰来 (please don’t bet on this – in real life it doesn’t work like this)

- 长久 – Not short term profiteering/compounding, but permanent compounding

- 兵家 – 未战先胜 – I win (or make money) the instant I bought the stock, just like what Warren Buffett says, because I have done my homework/diligence and know the value of the company (that I am buying)

- See my notes and more points in the pictures below

Panel Discussion – Hemant Amin; Francois Badelon; Hermann Simon; Kee Koon Boon; Judy Goh; Clive Tan

On Circle of Competence:

- Hermann Simon

- Slightly irrelevant topic – The less known a CEO is in the public, the more successful the company becomes

- Hemant Amin

- It’s not competence if you don’t know the extent of the circle of your competence.

- We use a bit too much IQ (exploring intellectual challenging and complex areas/companies/business models) than we need

- It’s okay not to have an opinion on things you don’t know (we use, or fall back, too little on the “too-difficult box”

- Define what you know, and stick with it

- Kee Koon Boon (some points are on different topics)

- Charlie’s mental model – multidisciplinary thinking

- Idea of resilience

- He likes learning knowledge and likes to know what makes people rise and fall, and that partly leads him to examine company leaders and then businesses and investing

- Investing is a multidisciplinary area

- He first developed accounting skills, then psychology to understand CEO’s or human’s mind

- Duality of a leader (note: duality mental model at play here) – Needs to be tech savvy, and also needs to always have customers’ needs in mind

On screening criteria and habits to develop

- Hemant Amin

- Let’s look at what not to screen for (note: inverse thinking mental model at play) – Not growing well, not scalable, not good management

- Is there a temporary problem? That’s where the opportunities lie

- Idea sources: Reading, reading, reading (this is what this business is about); Connecting the dots (this inevitably leads us to insights)

- Habits – Reading across diverse sections

- Hermann Simon

- Personal visit of companies is the most valuable information source

- Kee Koon Boon

- I’m a mono-maniac. I keep working and adding value to society, because I believe in my work (and that it adds value to society). This is the habit I work on

Day 2

Vishal Khandelwal – In Search of Value in an Irrational World

Finally got to meet Vishal (or rather I would prefer to call him the Safal Niveshak (the successful investor), after following his website and (epic and wisdom-filled) articles for more than two years. So, of course, I have to take a photo with him (such a rare chance)! The Warren Buffett of India!

Anyway, coming back to more serious topic, he presented very well (even though he kept saying that he hasn’t spoken to such large crowds before (he said so too for his previous video interviews)) and presented very useful concepts (more on the high level and strategic points, and temperament). Although I have known most of the concepts/points (mainly through his writings), it’s good to hear them again right out from him and get reminded of those lessons again.

And it’s also good to have met him in person, heard him spoke in person, talked to him and asked him the questions that I have (casually after his session on-stage) in person, and just have a feel of him as a person and understand his personality and the way he speaks/talks/holds himself. Because with these, the next time I read his writings, I would be able to picture him talking to me (note: thought experiment mental model in some way) and therefore able to learn and absorb/internalise those lessons better.

Also, it’s also surprising + lightening to see that (in my own view) he is very much Charlie Munger (or at least uses more of Charlie’s thinking skills in his own thinking) than Warren Buffett (although he learned a lot from Warren too, especially on investing), which proves to me that Charlie’s thinking models and skills are so wonderful that so many successful investors copy and practise them constantly and proactively, and makes me want to learn + implement + practise more of Charlie’s thinking (I am glad that I have read Poor Charlie’s Almanack and learned more about Charlie (‘s thinking and personality) before I heard from and met the speakers in VIS). Just to illustrate, within my first few minutes of conversation with Vishal, he already brought out two mental models (of Charlie’s) – inversion and pre-mortem – which I shall allude to below.

I really want to just list down the most important points that I got from him (note: focus), so here they are (see the more detailed notes in the pictures below):

- We are not rational. We make an argument first. Then we try to rationalise it. (Be very aware and wary of this, making sure that you don’t fall into this)

- Learning to say NO! (to various info sources, to noises, to (bad, unaligned, or even aligned but decent only) investment opportunities) is one of the most difficult, but important thing to do. Learn to say NO (time is one of your greatest resources/capital that you should allocate well as a good capital allocator)!

- Think LONG TERM and have a LONG VIEW! The long view (and long term focus) is an edge that we retail investors have. Look at seasons, not quarters, and one season is maybe 5 years or so (depending on the industry)

- Focus on the PROCESS, not the outcome. Also, focus on what we have control over (risk, cost, time, behaviour) (which we rarely focus on), not what we don’t (outcome, stock price) (which we only focus on)

- Investing is 51% ART, 49% science – I base my thesis and purchase decisions on what my GUT tells me after I’ve done all the research and absorbed all the info (the science).

- Beware of over-focusing on and be careful when using valuation, as all valuation is wrong, and all valuation is biased (since we have already spent a lot of time looking at it) (note: consider the importance of, and use of, margin of safety here)

- To avoid confirmation bias, especially when you are holding for long term, and leveraging up, a solution is to write down your thesis in an investment pad (you should have one), not on computer. Write down why you buy, and why you sell.

- His answers/points on the personal questions that I asked him:

- Be patient and keep doing the work

- If you can find only companies with high ROIC but little reinvestment opportunities (note: I think Vishal sees this type of company just like another cheap (value) company, which I think he doesn’t want to focus on), but not companies with high ROIC and much reinvestment opportunities (or if you are not willing to pay for them after you find them, either due to the really high or over- valuation currently, or because of your own psychological/mental barrier), then do these two:

- (1) keep finding, keep doing the work, keep flipping the stones (if the thesis for no. 1 doesn’t work out now (maybe because it’s expensive), go down the rung, look at no. 2, no. 3 in the market (in terms of market leadership (note: which is different from market share)), but don’t go further than that; and

- (2) be patient and wait for market crash (or correction is also good enough) if it is really overpriced (note: the same thesis might work out in the future too as time passes, not just from the decrease in price, but probably be due to the improvement of business and increase in earnings too – remember, there are two factors, not just one); or be more willing and ready to pay for quality, which requires you to really understand and appreciate Quality – compounding quality gives you a lot of ROI, so learn to understand and appreciate the value of quality (which is not easy, but work on it)

- And to help understanding and conceptualising the value of quality (and (probably non-linear) growth), Vishal uses/considers an expected return model as one of his tools (note: I believe he has not just hammers, so he doesn’t see everything as nails) (note: the far-out earnings and corresponding valuation can be used to understand/estimate a business better, but not as the main basis for investment/justification for a high purchase price).

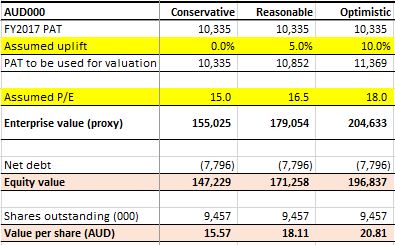

- First, estimate the earnings of the company 10 years down the road (have a long view, and this helps to take into account non-linear/ exponential dynamics).

- Second, apply a multiple. He personally uses a P/E multiple, and not EV/operating earnings. The important point is to be consistent, applying the same type of multiple across companies consistently – and in response to my follow-up question, he says that difference in or issues on interest expense, capital structure, etc should be taken into account in the estimated earnings (to go with the P/E multiple), and not taken into account by the tool (it is a tool!) (the type of multiple).

- Third, see whether the implied valuation range (remember, never have one single valuation number – always a range) gives you an annual return of 15%-20% (or whatever your number is), based on today’s price

- In estimating the long-term earnings of the company, use inverse thinking (e.g. think about what would make the company not achieve that level of earnings, etc; or what level of earnings would the company not achieve). Use Charlie’s pre-mortem concept too

- Also, force yourself to think about and imagine the long term potential growth. When thinking on this, think about per capita consumption now. E.g. If there is 1 out of 100 people consuming the product/service now, in the future if 5 out of 100 consume, then it’s a 5x growth, just in volume.

Hemant Amin – Value Investing in an Exponential World

Hemant is a local fund manager that manages a family fund of more than S$100M with a concentrated portfolio of 10 stocks, fundamental long. And a track record of >30% IRR for ~14 years – Impressive (with a good process)!

- He focuses mainly on (owner-managed) companies with high quality and high growth (best case), followed by companies with high quality and less growth.

- Understand business models! Then you won’t say the valuation (EV/EBIT) is high

- Largest position is in Bajaj Financial Ltd

- Business models + Technology + Scalability = Exponential Growth! (see picture below)

- Exponential growth – You have to think NON-LINEAR in this linear world – The rate of change itself is accelerating – Spot the slow boiling water, and make sure that you are on the other side

- Think about when does a company moves on the exponential curve (low marginal costs, etc)

- Understanding business model allows you to understand where the value is (value investing)

- Warren Buffet: “Investing is simple, but not easy”. Simple is deceptive

- Be wary of conveniently extrapolating historical results/data – Else librarians will be the best investors

- Investing is about connecting the dots, and finance is just one tiny dot

- Business models are on steroids in the exponential world (see picture below)

- Fish where the fish are – Decide where you want to fish (whether you want to fish only the high quality high growth fish)

- Management is not a moat, but his actions affect the moat

- Invest in “technology” (not necessarily technology companies), and your circle of competence on it – Ask how will technology scale your company or destroy your company

- Elephants (e.g. Google, Amazon, Visa, Microsoft, Adobe, Salesforce) can dance – Size can be a big advantage; Competition is for losers – Wait for good market opportunities for these dancing elephants

- Portfolio composition is key – Hemant’s top 5 positions take up 7%, top 10 positions take up 95%

- The zoom in, zoom out perspective/approach – E.g. Ask, can this business double in 3 years (24% p.a.) or 5 years (15% p.a.)?

- You need to have the discipline to be comfortable with LOW ACTIVITY, HIGH LEARNING, SIMPLICITY (read, read, read and do nothing else)

- Charlie Munger: “Simplicity is a hugely underestimated edge in investing and in life”

- Q&A: How do you control risks with a concentrated portfolio? (I personally this question, or rather the answer to this question, is very good and useful for me)

- Hermann: We do not go out and buy 20% position in a company straight (by doing this, you’re saying that you’re GOD and know everything). We buy <5% every time (start small), then as time goes, we know better and better and more about the company (and the industry), then we accumulate more to a bigger position

- Side point: Mohnish Pabrai has a concentrated portfolio too, and sometimes he got burned

- Vishal: Think like a parent (borrowing from Phillip Fischer) – only manage the amount that you can

- Q&A: Valuation method

- Vishal: Warren Buffett talks about DCF, but Charlie Munger says he has never seen Warren done one – ROFL. I personally use multiples (note: good to know that I am on the same page with Vishal here)

- Hemant: Even the CEO of the company can’t predict 10 years cash flow, how can you? Remember, our world is dynamic and businesses react

- Q&A: Timing the market?

- Hemant: Crash is relative to your understanding of the business – see it as owning a private house. We are stuck in the psychology of portfolio management (note: I can’t really recollect the essence of this point now)

- Vishal: Quality is in itself a margin of safety – The longer you hold, the better off you are. Conversely, the longer you hold bad businesses, the worse off you are (note: water the flowers, not the weeds)

Hermann Simon – Hidden Champions – Role Model for Leadership in the 21st Century

- This is Hermann’s second part

- Best bottling company – Kronos (America) – It was achieved by the fearlessness of the founder – with courage (a trait of hidden champions), not with strategy

- To internationalise and be a global leader, you need long term perspective, long-term orientation, and have the orientation, stamina and perseverance to run the marathon – Strategy is not a short term mater

- Look out for CEOs with long tenures (note: ask, what’s the CEO tenure for your company?) – What can a CEO build in only a few years?

- Average tenure of large corporations: 6 years

- Average tenure of hidden champions: 20 years

- Average tenure of records – Hans Riegel (Haribo bears): 67 years

- Employees: Look for high productivity in hidden champions

- High productivity indicators: High qualification (uni degree) – Knowledge > Cheap labour in this world of globalisation

- Employee turnover rate – Hidden champion has 2.7% turnover

- Hidden champions have deep value chain

- Total quality control – E.g. Wanzl trolleys

- Faber Castell – We grow our own wood in our own plantations – Consistency in quality

- No outsourcing of core competences

- Uniqueness can only be created internally – If you buy from others, your competitors can do the same too

Intervarsity Stock Research Challenge Presentation Finals – Judge Panel: Hemant Amin; Hermann Simon; Kee Koon Boon; Francois Badelon

5 companies were presented. I only managed to hear the first 3 and had to leave. Overall, I felt that they had done a lot of homework and research, but the companies all have some certain negative points that made them not compelling.

- Hamamatsu Photonics (TSE: 6965) – World leader in PMTs, with dominant market share. But low margins, low ROE and low growth rates – Maybe problem lies in sales and marketing front (low asset turnover)

- Time Technoplast Limited (BSE: 532856) – Polymer drums – Be careful that high market share does not necessarily translate to high market leadership (for high-value products)

- Nihon Kohden (TSE: 6849) – EEG market – electronic medical equipment. Has broad product range for hospitals that are compatible and integrate with each other (including hardware and software). Recurring consumables. But, low historical growth and sub-par gross margins compared to Johnson & Johnson and others (e.g. Medtronic). Suggestion: Look at its Japanese competitors, Sysmex, which has high export %, better margins and high % of consumables

Ending thoughts

That’s all for Value Investing Summit 2018. I am glad that I attended it, with the most valuable part being able to meet the few great investors from the world and learning from them.

VIS 2019 will be held in Kuala Lumpur, Malaysia on 19 and 20 January 2019. I shall consider attending if it has a good line-up of speakers (good value investors, like this time), so I shall wait for more details first.

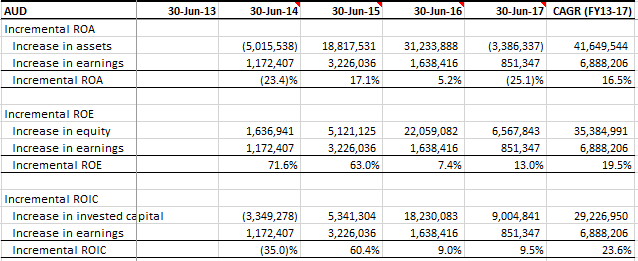

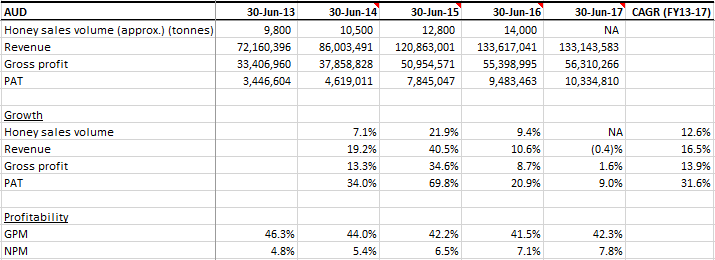

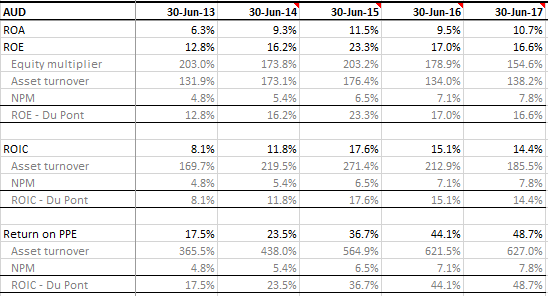

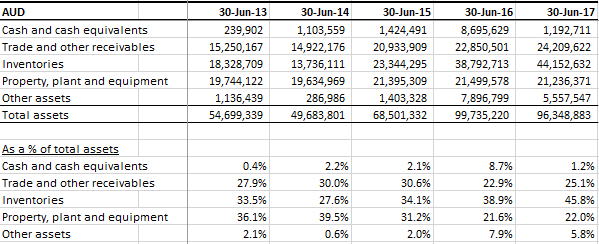

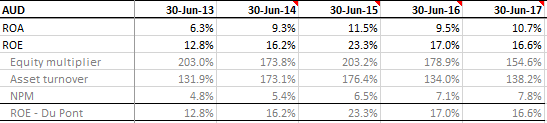

As seen in the table above, Capilano’s ROE started at 16% in FY2014, went up to 23% in FY2015, before coming down to 17% in FY2017. Although the ROE in FY2017 sort of went back to its original level three years ago, its individual Du Pont components have changed quite some extent:

As seen in the table above, Capilano’s ROE started at 16% in FY2014, went up to 23% in FY2015, before coming down to 17% in FY2017. Although the ROE in FY2017 sort of went back to its original level three years ago, its individual Du Pont components have changed quite some extent: